Quarterly Rebalance Update

QUARTERLY ALLOCATION UPDATE OVERVIEW:

After a brief hiatus to close out election season, we are resuming our risk-on

stance. We are reinstating a 4% lean into equities across our Eight Oaks

Financial strategies, emphasizing the momentum factor as we see

opportunity through the end of the year for delayed business activities to push

markets higher. We slightly increased our allocation to high-yield corporate

bonds. We also swapped out a couple mutual funds for similar ETF

counterparts.

REASONING FOR ADJUSTMENTS:

The relief rally began immediately after the US election results came in. With

the election in our rear-view mirror, businesses and investors can move

forward with actions they may have delayed during the period of uncertainty

before the election. We believe there will be a surge in market activity moving

into the last few weeks of the year, providing a tailwind to stock markets. We

moved further into equities and specifically into the momentum factor to

capitalize on that tailwind.

Strong economic fundamentals and resilient consumer spending continues to

support corporate profits. We see some opportunity to capitalize by slightly

increasing our allocation to high-yield corporate debt. Not only are the offering

historically attractive yields, but credit quality in this area has improved as

issuers have become more resilient.

Finally, we swapped out two mutual fund strategies for similar Exchange

Traded Fund (ETF) strategies. ETFs offer a similar product in a more cost-

effective and tax-efficient vehicle.

ADJUSTMENTS:

• Increase lean to equity over fixed income by 3% - bringing the total

equity lean to 4%

• Introduce Invesco S&P 500 Momentum ETF (MTUM)

• Slightly increase weight to high-yield corporate bond issues by

introducing BlackRock Flexible Income ETF (BINC)

• Swap out American Funds Capital World Growth and Income (WGIFX)

for Capital Group Dividend Growers ETF (CGDG) and Hartford Equity

Income (HQIIX) for Capital Group Dividend Value ETF (CGDV)

HIGHLIGHTS IN THE PORTFOLIO:

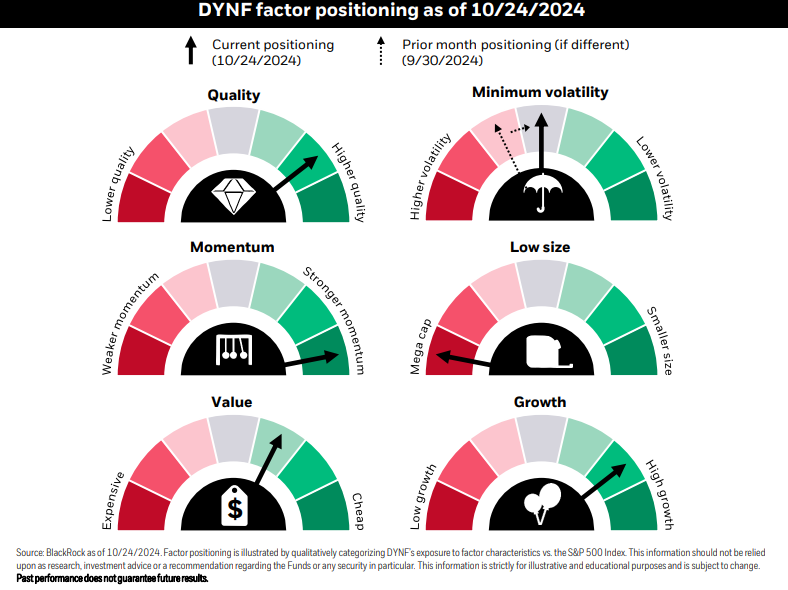

We have been happy with the management of the iShares US Equity Factor

Rotation ETF. The fund managers rotate between factors such as small vs

large size (capitalization), high vs low quality, and high vs low growth. See the

image below for a breakdown of the fund’s most recent positioning.

See the link below for a product brief about iShares US Equity Factor Rotation

ETF.

DYNF Factor Positioning

Disclosures

Investing involves risk, including the potential loss of principal. No investment

strategy can guarantee a profit or protect against loss in periods of declining

values.

Asset allocation does not ensure a profit or protect against a loss.

High yield/junk bonds (grade BB or below) are not investment grade securities,

and are subject to higher interest rate, credit, and liquidity risks than those

graded BBB and above. They generally should be part of a diversified portfolio

for sophisticated investors.

ETFs trade like stocks, are subject to investment risk, fluctuate in market

value, and may trade at prices above or below the ETF's net asset value (NAV).

Upon redemption, the value of fund shares may be worth more or less than

their original cost. ETFs carry additional risks such as not being diversified,

possible trading halts, and index tracking errors.

Investing in mutual funds involves risk, including possible loss of principal.

Fund value will fluctuate with market conditions, and it may not achieve its

investment objective.

Tracking # 658907

Best,

Andy Chatham